Trusted by 500+ brands

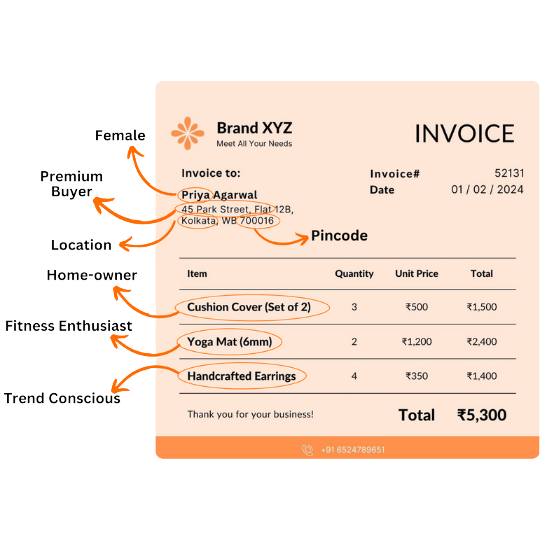

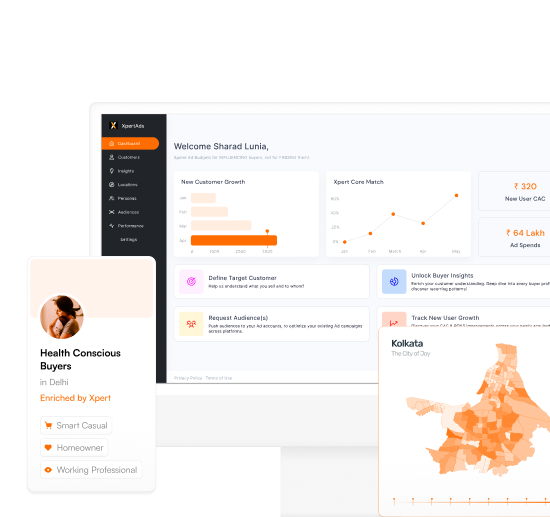

Built On India’s Largest Consumer Purchase Graph

Xpert stitches verified purchase data across brands and categories from both online platforms and offline POS systems, we understand not just who buys, but the where, what & why behind it too!

ACTUAL BUYERS

INDIAN PINCODES

PRODUCT CATEGORIES

OMNICHANNEL BRANDS

What Can Our Retail Expansion Do?

Discover Untapped Store Opportunities

-

Xpert pinpoints high-potential cities and neighborhoods with the strongest verified buyer density, while benchmarking competitor presence and store performance.

-

Identify the top 20% of pincodes housing over 80% of your buyers and uncover markets where demand is strong but competition is underpenetrated.

Choose the Right Cities for Growth

-

Xpert ranks cities by verified buyer share, current coverage, and market demand strength — revealing where demand is high but under-served.

-

Benchmark buyer penetration and expansion potential to prioritise rollouts that promise faster growth and higher ROI.

Evaluate Store Sites with Precision

-

Each potential site is scored on verified buyer proximity, affluence, rentals, accessibility, and surrounding brand mix.

-

Xpert predicts revenue potential for shortlisted sites, helping you invest only where verified demand supports sustained store performance.

Strengthen General & Modern Trade Networks

-

Xpert identifies underserved areas where verified buying demand exists but your GT or MT coverage is weak.

-

Expand your distribution efficiently by targeting top residential clusters and buyer-rich pockets driving trade performance.

Benchmark Competitor Presence & Performance

-

Xpert maps competitor outlets and overlays them with verified demand to identify saturation and whitespace.

-

Compare your own stores against catchment potential to flag underperformers and prioritise new openings in high-demand zones.

Why Brands Trust Xpert for Expansion?

-

No Population Guesses

Every city and site decision is based on verified buyer data, not census or survey estimates.

-

No Risky Site Bets

Xpert scores every site by real purchase density, affluence, and complementary brand presence — replacing intuition with metrics.

-

No Blind Competitor Imitation

Xpert goes beyond presence to identify which competitor outlets actually perform, helping you invest where others fail.

Case Studies

Check out how top brands have leveraged Xpert to unlock growth

VIP Bags - Planning Store Expansion Using Precision Locational Data

Optimizing Panasonic’s General Trade Distribution Using Buying Demand Data

Precision Placement: Optimizing Coca-Cola’s Premium Product

Frequently Asked Questions

Find answers to commonly asked questions about our product or service in our comprehensive FAQ section.

Yes. Identify underperforming stores, optimize locations, and prioritize expansion in areas where demand already exists

By mapping competitor strongholds, untapped hotspots, and high-spending neighborhoods, you can make smarter expansion decisions before your competition does.

Absolutely. Locational intelligence helps match product assortment to buyer preferences in each area, ensuring higher conversions.

It’s based on verified purchase trends across cities, pin codes, and districts—ensuring accuracy beyond traditional demographic estimates.

Data-driven insights help pinpoint the most profitable pin codes and localities, so you focus on areas with real buying potential, not just crowds.

Ready for our Retail Expansion to supercharge your expansion plans?

.png)

.png)